7th Pay Commission Impact is more than just about revised salary figures—it was a turning point for millions of Indian families. When the commission’s recommendations were implemented in 2016, they not only updated salaries and pensions but also raised fresh debates about equity, fiscal prudence, and the future of public service motivation.

Nearly a decade later, as discussions around the 8th Pay Commission intensify, it’s important to look back—not just to analyze numbers, but to understand how those changes rippled through homes, offices, classrooms, barracks, and bank accounts across India.

7th Pay Commission Impact: The Vision and Purpose Behind the Reform

The 7th Central Pay Commission, chaired by Justice A.K. Mathur, was formed with one goal: to modernize the pay structure of India’s central government employees and make it transparent, just, and performance-friendly. Unlike previous commissions, the 7th CPC emphasized rationality over hierarchy and brought in a unified pay matrix that reduced ambiguity across departments.

It affected over 1 crore people—including serving employees, pensioners, and their families.

7th Pay Commission Impact on Central Government Salaries

- Minimum basic pay increased from ₹7,000 to ₹18,000

- Fitment factor: Salaries multiplied by 2.57 across pay levels

- Maximum salary touched ₹2.5 lakh (Cabinet Secretary level)

- Pay Bands & Grade Pay system abolished and replaced with a clean Pay Matrix

- Transport, House Rent, and Dearness Allowances rationalized and linked with inflation

Real-life impact:

A junior clerk earning ₹8,000 basic pay in 2015 suddenly saw their gross salary rise above ₹25,000. For a middle-class family, this meant:

- Better EMI eligibility

- Stronger retirement savings

- Access to private schooling and insurance

- But also—rising lifestyle inflation

For Pensioners: Stability, But Not Without Gaps

Pensioners saw an increase in minimum pension to ₹9,000 and a revised formula based on notional pay in the new matrix.

They also benefited from:

- Gratuity ceiling raised to ₹20 lakh

- Extra pension slabs at age 80, 85, 90, 95

- Family pension adjustments

However, many pensioners—especially from the pre-2006 era—still felt the pinch of disparities, leading to fresh demands for parity and a one-rank-one-pension-like solution for civilians.

Departmental Impact: From Railways to Education

Railways:

With over 13 lakh employees, Indian Railways was one of the biggest beneficiaries. Employees like drivers and guards saw both pay and incentives rise. However, operational stress and privatization anxieties diluted enthusiasm.

Defense:

- Military Service Pay (MSP) was introduced

- Disability pension revisions invited widespread protests

- Discontent still simmers around OROP parity and rank equivalence

Education:

- Kendriya Vidyalaya, Navodaya teachers received fair pay upgrades

- University faculty benefited under UGC matrix

- Contract-based educators (Shikshamitras) remained excluded—fueling protests in states like UP and Bihar

Criticism of the 7th Pay Commission Impact: What Was Missed?

While the hike was welcomed, it wasn’t without criticism:

- Minimum pay demand was ₹26,000—not ₹18,000

- Employees wanted fitment factor of 3.0 instead of 2.57

- Several unions called it a “partial relief”, not a long-term solution

- Contract and outsourced workers remained untouched

“The 7th Pay Commission made the permanent staff smile but kept the aspirational youth out,” remarked a retired IRS officer in 2017.

Economic Impact: The ₹1 Lakh Crore Question

Implementing the 7th CPC added ₹1.02 lakh crore to the government’s expenditure:

- ₹73,650 crore – salaries

- ₹28,450 crore – pensions

While economists feared it would bloat the fiscal deficit, the actual result was a boost in consumer demand, home loans, and auto sales in the following quarters—proving that public sector liquidity can drive market cycles too.

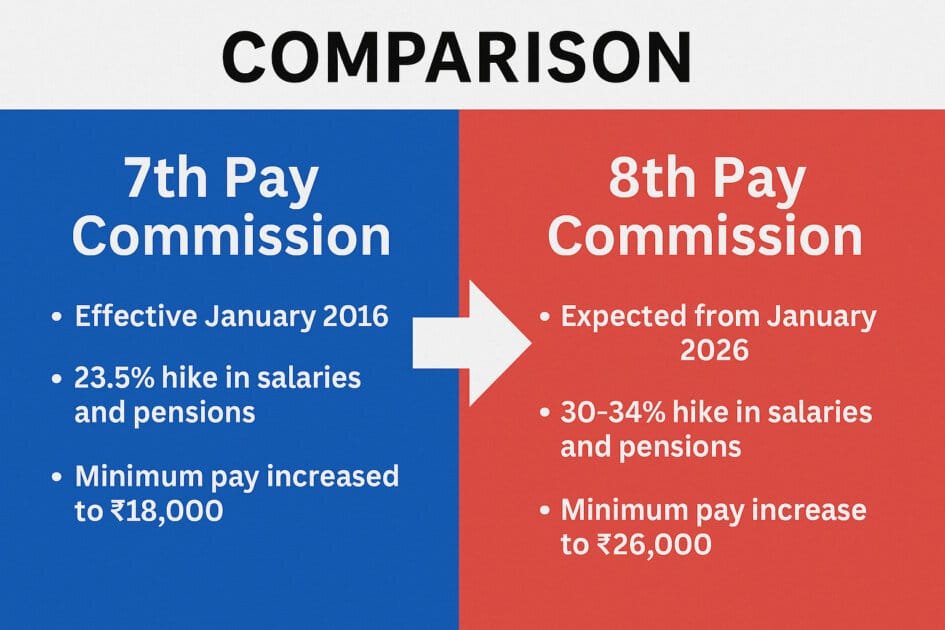

Looking Ahead: What It Means for the 8th Pay Commission

The 7th CPC laid the groundwork—but also left unfinished business:

| Metric | 7th CPC Result | 8th CPC Expectation |

|---|---|---|

| Fitment Factor | 2.57 | 1.83–2.5 (in deliberation) |

| Basic Pay Range | ₹18,000 – ₹2.5 lakh | ₹26,000 – ₹3 lakh (expected) |

| Allowance Reset | Yes | Yes, with performance linkage |

| Pension Model | Defined Benefits | Unified Pension System hybrid |

| Contract Worker Status | Ignored | Major policy focus anticipated |

📌 Here’s a detailed comparison between 7th and 8th Pay Commissions

A Step Forward, But Not the Last

The 7th Pay Commission was a bold reset for India’s bureaucracy and service sector. It brought structure, consistency, and dignity—but it also highlighted gaps between permanent vs contract, defense vs civilian, and senior vs junior levels.

As we move toward the 8th CPC era, the goal should not just be numbers on paper—but real equity, performance recognition, and inclusion of those still left behind.

Because in a true democracy, fair pay is not a benefit—it is a right.

Table of Contents

AryaLekh (DoFollow)

- 8th Pay Commission 2025 Update: Salary and Pension Hike Likely by 30–34%, Timeline and Fitment Factor Explained

- Unified Pension Scheme 2025 Explained: Big Relief & Benefits for Government Retirees

- India Fiscal Deficit 2025 – Economic Outlook and Pay Commission Impact

7th Central Pay Commission Official Report (IndiaGov)

Read the complete 7th Pay Commission report submitted to the Government of India.

Department of Expenditure – Ministry of Finance (GoI)

The Department of Expenditure regularly updates pay matrix rules and DA changes.

Pensioners’ Portal – Government of India

Updates on pension policies are available on the Pensioners’ Portal.