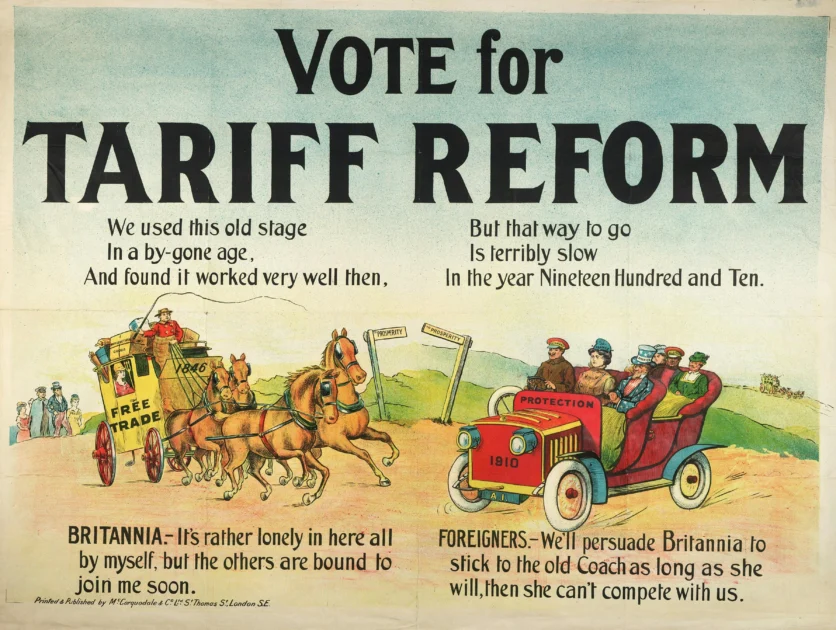

US tariffs on India have reached a historic high, with President Donald Trump imposing a total of 50% tariffs on several key Indian export categories. This dramatic move, implemented in two phases—25% from August 7 and an additional 25% from August 27—marks one of the most severe tariff escalations in recent US-India trade relations. The tariffs are being seen as a retaliatory action in response to India’s continued crude oil purchases from Russia, despite global sanctions. As a result, Indian goods in the U.S. are set to become significantly more expensive, impacting both exporters and American consumers.

With India already facing steep anti-dumping duties and countervailing taxes in sectors like shrimp and textiles, this sudden increase is expected to cause widespread disruption across export-dependent industries.

According to global trade analysts, this is one of the most severe tariff shocks India has faced in decades. The repercussions will be felt not just in trade numbers but across jobs, MSMEs, global market confidence, and pricing for U.S. consumers.

US Tariffs on India: Key Sectors Hit by Trump’s 50% Hike

President Trump signed an executive order that raised total tariffs on selected Indian imports to 50%. This includes a new 25% tariff added to existing standard duties.

The decision was primarily triggered by:

- India’s continued crude oil imports from Russia

- Growing India–Russia strategic ties

- U.S. attempts to apply economic pressure via secondary tariffs instead of direct sanctions

This tariff hike applies to multiple product categories, especially those where India enjoys a significant market share in the U.S.

Why US Tariffs on India Could Trigger a 50% Drop in Exports

The sectors worst affected by the hike are those heavily dependent on the U.S. for trade volumes. Many of them are labour-intensive, MSME-dominated industries, and price-sensitive in global markets.

| Product Category | Annual Exports to US | New Effective Duty Rate |

|---|---|---|

| Gems & Jewellery | $12 billion | 52.1% |

| Textiles & Apparel | $10.3 billion | 59–63% |

| Electrical Machinery | $9 billion | 51.3% |

| Organic Chemicals | $2.34 billion | 54% |

| Shrimp & Seafood | $2.24 billion | 33.26% |

| Leather & Footwear | $1.18 billion | ~50% |

| Carpets & Furnishing | $0.8 billion | 52.9% |

Exporters React: “Margins Cannot Sustain This Shock”

🔹 Gems & Jewellery

Colin Shah, MD at Kama Jewelry, stated:

“This puts India at a 30–35% disadvantage compared to countries like Thailand and Vietnam. Over 55% of our U.S.-bound orders are at risk.”

🔹 Textiles & Apparel

The Confederation of Indian Textile Industry (CITI) warned:

“The tariff hike comes at a time when Indian textiles are already struggling against Bangladesh, Vietnam, and Pakistan. This could collapse order books in the U.S.”

🔹 Seafood Exporters

Yogesh Gupta, MD of Megaa Moda (Kolkata-based exporter), said:

“Shrimp is already under anti-dumping and countervailing duties. With the additional 25%, our total duty becomes 33.26%. U.S. buyers are turning to Ecuador and Vietnam.”

How Indian MSMEs Are Coping With US Tariffs on India

According to a report by Global Trade Research Initiative (GTRI):

- India’s U.S.-bound exports could fall by 40–50% in the next 6–12 months.

- MSME-led industries will struggle to absorb the cost, leading to potential layoffs and factory closures.

- Exporters are putting existing orders on hold, seeking buyers in alternative markets.

📊 Estimated Impact:

- 0.6% GDP contraction in FY2025–26 (moderate forecast)

- ₹90,000–₹1,25,000 crore loss in export revenue

- Up to 1 million direct jobs impacted in textiles, jewellery, and footwear sectors

Who Will Actually Pay the Price for the Tariffs?

🔸 U.S. Buyers and Retailers

- Higher landed costs will lead to price increases for consumers.

- American retailers may shift sourcing to other countries, but quality and timelines could suffer.

🔸 Indian Exporters

- Profit margins, already under pressure due to global inflation and high shipping costs, will take a further hit.

- MSMEs will struggle to maintain long-term contracts with U.S. partners.

🔸 Indian Economy

- Falling exports will affect trade surplus, rupee strength, and job creation in export hubs like Surat, Tirupur, Ludhiana, and Kanpur.

India’s Official Response: PM Modi’s Statement

Prime Minister Narendra Modi responded publicly on August 6:

“India is prepared. We will never compromise our sovereignty or energy needs. The government will stand by its exporters and ensure national interests are protected.”

The Ministry of External Affairs called the tariffs unjustified and excessive, signaling that retaliatory trade measures are under review.

Possible Steps India May Take Next

| Response | Details |

|---|---|

| Explore WTO Challenge | India may move a dispute resolution case under WTO for unfair tariff hikes. |

| Bilateral Talks with U.S. | New diplomatic rounds likely with USTR (US Trade Representative) office. |

| Trade Diversification | More focus on EU, ASEAN, Middle East, Africa markets. |

| Support to Exporters | Subsidies, PLI extension, and credit guarantee schemes under review. |

Can India Bounce Back? Yes, But Strategic Shifts Are Needed

Despite this major blow, experts believe India can mitigate long-term damage through:

- Rapid trade diversification (Australia, Africa, Middle East)

- Boosting domestic logistics and port infra

- Improving product quality and branding to enter premium markets

- Strengthening FTAs with EU and UK for tariff-free access

A Wake-Up Call for India’s Export Strategy

The 50% tariff hike by the U.S. is not just a trade issue—it’s a strategic challenge. It highlights India’s dependence on select global markets and the urgent need to restructure its export roadmap.

While exporters and industries face immediate hardships, this may become the trigger India needs to innovate, localize production, and seek wider global integration.

India’s resilience and adaptability, combined with the government’s response and industry efforts, will decide whether this crisis becomes a setback—or a turning point.

1. Office of the United States Trade Representative (USTR)

According to the Office of the United States Trade Representative (USTR), tariff actions were taken to penalize certain global trade practices.

2. Ministry of Commerce and Industry, Government of India

As per data from the Ministry of Commerce and Industry, India’s total exports to the US crossed $86 billion last year.

3. GTRI (Global Trade Research Initiative)

A report by the Global Trade Research Initiative (GTRI) indicates a 40–50% drop in Indian exports due to the tariff hike.

4. World Trade Organization (WTO)

India may escalate the matter to the World Trade Organization (WTO) if a bilateral resolution isn’t achieved.

5. PTI News via Economic Times or Business Standard

According to a PTI report published by Economic Times, sectors like textiles and gems are among the worst hit.

AryaLekh (DOFollow) :

- Trump 25% Tariff on India: The Shocking Trade Blow and Russian Oil Penalty Explained

- Global News Today 2025: Breaking Updates on World Economy & Political Shifts

- SBI Junior Associate Recruitment 2025: Notification Out for 5180 Clerk Posts

- Global News Today 2025: Breaking Updates on World Economy & Political Shifts

- Friendship Day 2025 – Golden Lessons of Love, Trust & Sacrifice That Can Make or Break Your Bond

- UPPSC LT Grade Teacher Recruitment 2025 – Ultimate Guide to This Golden Opportunity